RESEARCH & ADVISORY

Market Insights: Bitcoin Mining

12 May 2023

DOWNLOAD PDF: I&D_Market_Insights_Geopolitics & BTC Mining 230512

GEOPOLITICS & BITCOIN MINING

“It’s more about capital flow control and not about green energy”

INTRO: “Geopolitics & Bitcoin mining” topic for this report came together from experience and engagements with various projects in bitcoin mining sector, where each region moving in its own development path depending on external factors such as energy, capital control and geopolitics (should not make any reference to any conspiracy theories, but pure strategic economic decisions by various countries). It is not specially conducted research but more of a market insider commentary. For disclaimer have to state that assessment based on own expertise in 3 sectors that have more overlaps than one may think: 1. being in bitcoin mining sector since 2017 (time when first waves on projects started moving into capital markets via RTO); 2. prior experience in traditional Metals & Mining (with focus on REE – Rear Earth Metals, nowadays also known as part of Critical Raw Materials – popular narrative for all politicians – why they likely to miss their green goals); and 3. Over 10 years in banking & strategy within multilateral development bank – MDB institutions more than anyone possess strong experience & tools for operating in emerging markets and sectors globally through financing and policy engagements…

The report has overview of bitcoin mining Countries: active in bitcoin mining / were active before / might grow in the future.

Also Global Hashrate Mapping with comments re stats used in the media and why I don’t referring to it.

Some of you may agree with content, other strongly disagree, but will welcome all constructive feedback.

WELCOME TO BITCOIN MINING INFINITE GAME!

Bitcoin mining regularly viewed through 4-year bitcoin halving cycles that allow natural refresh to ecosystem and eliminates any inefficiencies. Nowadays bitcoin mining became more exposed to global geopolitical shifts impacting everyone lives and pushes bitcoin mining sector into further transformation.

Bitcoin is considered by many as instrument of freedom because of truly decentralised characteristics. Bitcoin mining is backbone for maintaining decentralised nature of bitcoin blockchain through transactions processing. Bitcoin mining process comes with financial incentives (block rewards) in order investments into infrastructure to continue for each 4-year cycle and encourage technological upgrades including improving efficiency of mining hardware (J/TH), as well as integration with immersion cooling solutions for power & thermal management and improving internal treasury & risk managements procedures.

Latest geopolitics & economic shifts push bitcoin mining into critical evaluation of risk in maintaining existing business operations, development pipeline for new regions or upgrades/expansion. Decade of 2020s brings change that set transition to multipolar system (USA, EU, BRICS countries) that already effecting existing business models especially for businesses that exposed to cross border operations within those multipolar blocks. Bitcoin mining business has been keeping itself politically neutral but cannot ignore such geopolitical changes. It is first time for this sector I would put (geo)political risk above market risk for the following reasons:

- Energy crisis for interdependent regions, for example some regions in Europe and Central Asia that were historically self-sufficient in energy with event evolving in 2022 experienced themselves full effect of energy crisis. And making bitcoin mining (as energy consumer) partially escape goat for blame and public sacrifices – unfortunately for some cases only to divert attention from real causes of energy problems;

- Capital control restrictions in some regions can view bitcoin mining as instruments to bypass capital control regulation and in retaliation government has only two options (examples):

- (In China) to ban it in order to stop allowing local Yuan being converted into BTC or

- (in Russia) plan to align with other commodity sectors for local BTC production be transparent through custody and trading executed via local approved providers.

- BTC to fiat On/Off ramps (operational cashflows)– in normal circumstances this is typical AML function on validating procedures and counterparties used for facilitating such flow, but with latest developments within banking and sanctions it is becoming a tool that has to link directly with (geo)political risk as well. Bitcoin mining BTC/fiat settlement level of risk exposure depending on miner’s country of operation, as well as investors and other intergroup exposures within current multipolar environment (USA, EU, BRICS). As tension continue to rises especially for USD based on/off ramps, with it will rises tension for compliance / credit officers across the banks that only will be limiting operations.

- Multipolar blocks already set in motion agenda of De-dollarisation from one side and narrowing down USD corresponding bank channels on another. Due to historically inherited dominance of USD settlement (for digital assets as well) such development creates more pressure and makes market participants look for backup or alternative to USD settlements (especially non-US). This is not only result of geopolitics but also due to developments in USA over last months and especially weeks, that shaken up the whole digital assets industry as few key-systemic banking infrastructures for crypto / fiat flows were eliminated. This sets in motion much faster deployment of alternative payment processing via banks that only operate with BRICS based currencies (with zero exposure to USD and EUR).

- In addition to banks across different countries, have to highlight big role of two remaining systemic players for digital assets (don’t want to crash ego of anyone but those two I see): Bitfinex and Binance. Both was actively in process of being squeezed out of USD space (and we still to see position of BRICS). However, Bitfinex securities has already the strongest instrument on the market – USDT and offering of other currencies and commodities (in addition to gold) could position is as ultimate non-government payment rails and potential bridge between multipolar blocks as well (especially those in opposition – USA/EU to BRICS). Use case for Binance can be in Kazakhstan in getting regional rails from Kazakh tenge/CBDC into global marketplace available through Binance. The bottleneck for development in Kazakhstan was always banking being scared to loose their USD corresponding bank relationship (and it was the norm to have one), but already stopped having a status “must have”. So regional bank without USD nor EUR correspondent accounts could potentially offer local currency on/off ramp (since all regional banks with existing USD and EUR banking relationship very unlikely to service Binance taking into account position of US)

Small reference to own experience before getting back to on/off ramps: back in 2018 (together with European office of one big 4s) during assessment of digital assets development potential in various jurisdictions, USA was one of 8 shortlisted, but not a priority due to lack of clarity in position on crypto between federal and state level and hence at the time focus was on Europe as it already had banking support in Switzerland and Germany was one of first countries to recognise BTC and ETH back in 2011. However, by end of 2019 when business required active development it became apparent that the only self-sufficient developed ecosystem was in USA that (managed to grow) already included banking service, prime brokerage, custody and compliance services like Chainalysis. Also, many institutional focused and business relationship were established by players thanks to US ecosystem. (Still should give credit to Canada here, as key stepping block in transitioning for bitcoin mining into capital markets via few RTO – reverse take overs done during 2017-18.) So, US became main driver for digital ecosystem but recent events in US made some collateral damage that trigger especially for non-US based businesses to seek alternative in non-US banking support (which is still limited but will develop fast). This is something that no one will believe was possible just a year ago and now it looks like we are back to 2018 but path ahead even more challenging than before.

There will be more action in coming months that make further impact on banking (inside and outside US) with requirements proposed via US Treasury De-Risking strategy …here are few extract that I picked up earlier: “covered financial institutions have a regulatory obligation to conduct enhanced due diligence (EDD) concerning correspondent accounts for foreign financial institutions and private banking accounts established for non-U.S. persons who are direct or beneficial owners of the account.”…another, (personally see) as strong wording with intend: “high-risk cross-border corridors” clearly intended to narrow down capabilities for cross boarder payments,…with another reference worth noting as well that….”correspondent banks need to have a certain volume of transactions from the respondent bank to justify the costs of maintaining the relationship.”. This means only one thing for digital assets space (and Bitcoin mining), narrowing down USD cross border settlement in fiat for typical flows such as trading BTC to fiat, intergroup cross boarder transfers and payments for opex & capex. Tendency will continue to grow in accepting additional fx risk & costs for operating in other fiat currencies, even though deepest liquidity remains within USD. Especially will be effecting bitcoin mining done in regions other than US and Canada.

BRICS (Brazil, Russia, India, China and South Africa) countries accelerating de-dollarisation developments with Chinese Yuan in lead position to replace USD & EUR trade flows among BRICS members and any regions that conduct business with BRICS. Meaning that more pressure will be on banks with USD flows as they will be required to reconsider some exposure to BRICS countries/businesses and even threat of secondary sanctions like it was already mentioned to Central Asian countries in order to stop any exposure to Russian trade flows in the region. Kazakhstan is only bitcoin mining hub in Central Asia region that will need to have closer reassessment.

However, seems that sanctions only accelerate process for de-dollarisation among BRICS block, should see more banking groups getting established with purpose only operate with BRICS denominated currencies and digital assets / CBDC – Central bank digital currencies. This process is happening faster than anyone anticipated and seen on news as more countries stepping into de-dollarisation process. LATAM as emerging regions for bitcoin mining growth might be viewed as epicentre for such developments. LATAM has decades of activity in geopolitical interests from US, Russia, China, EU because of vast resources (including my favourite – Critical Raw Materials. For those that haven’t heard CRM term before – without securing supply of Critical Raw Material many of those political declarations with green goals will remain no more than declarations, unless political decisions will be taken to use any financial means possible to secure supply of CRM, which mostly located in China but has high concentration in LATAM and Africa).

What such developments in on/off ramps will mean for bitcoin mining? Mostly will impact business with group structures across multiple jurisdictions, groups with centralised treasury management and “hashrate pooling” from multiple location with requirement for regular fiat settlements nad payment processed to various jurisdictions. As an example of possible scenario: one country (with bitcoin mining potential) in LATAM can align business interests with China or get syndicated financing from BRICS block, that likely could trigger limitations for USD corresponding banks relationship in this country or even secondary sanctions. This will create payment processing problems for local company, especially those directly owned by USA based companies / investors and international groups that also has US based subsidiaries or counterparties.

To eleborate more on terminology: “Hashrate pooling” similar to term cash pooling, related to hashrate management on group level, with hashrate pulled from different countries/location for centralised treasury management. Not to mix with term “hashrate blender” that intended to disguise origins for part of hashrate.

“Bitcoin mining as competitor or an ally for energy and capital” this is another reason that bitcoin mining will be getting more attention, both positive and very negative.

For example, Paraguay has excess capacity of hydropower that exports to Argentina and Brazil. For the country this is purely economic decision to determine what value added from each produced kWh remains for Paraguay. One option will be to transport energy to Brazil & Argentina and another to use it in Paraguay for local industries. Bitcoin mining is only sector with energy dependency that allows direct conversion of such energy into revenue stream without reliance on external clients or need to build supply chain i.e. will be fully self-sufficient (as long as site has security, electricity and telecom). This puts bitcoin mining in position of competitor for energy with users that receive exported power (or other local consumers).

Also, bitcoin mining (and its investors) might be considered as competition to traditional FDI (Foreign Direct Investments) and compete with MDB – Multinational Development Banks/institutions that interested in financing projects and establishing policies within a particular country. Bitcoin mining investment in this case acts as competitive capital provider to MDB especially in Power & Utility sector (one of key sectors within portfolio of MDBs). Coming back to example of Paraguay, if government needs funding for developing smaller regionals networks in order to improve access to electricity for wider population (and reduce firewood consumption that leads to cutting wild forest) than any financing that will allow co-investment into grid and build of bitcoin mining facility will be considered competition to MDBs.

Russia had to divert its energy flow from EU in 2022 and being left with large excess capacity, bitcoin mining can be its new client: for example, 1 GW of power was previously supplied to Finland from Russian North East region which has similar weather conditions to north of Sweden & Norway. With bitcoin mining deployment Russia can potentially offset energy supply losses and build up hashrate (more than was lost in Nordic due to energy crisis and taxes) and cost of such build up has cheaper entry point within current market conditions and flooded hardware market.

Due to energy crisis Kazakhstan had significant demise of bitcoin mining sector (with some operations remaining) and this crisis also effected more countries in Central Asia (including Kyrgyzstan) that will be getting some energy supply via Kazakhstan from Russia to cover deficits (news re supply to Kyrgyzstan already announced). As a result of increase in energy supply through Kazakhstan, some energy supply can “resurrect” bitcoin mining sites that were previously shutdown (energy supply from Russia will not be coal-based generation as well that will limit use of narrative for Kazakh hashrate making bitcoin mining less green, but will add complications that energy source is from sanctioned country). Kazakhstan has all necessary regulatory setup and infrastructure in place to scale up bitcoin mining deployments. Such approach potentially can allow (as long as grid network is upgraded first of all in Kazakhstan) to build up more energy infrastructure in Central Asia region for bitcoin mining operations and other use. Also, will allow Russia increase its energy supply in the region that has growing demand for energy and option to build up energy generation or focus on network upgrades and more reliance on Russian energy supply. But such developments increase risk of secondary sanctions for Kazakhstan.

As bitcoin mining in Europe fades away, we should not cross out Europe from bitcoin mining map (not yet). Lately bitcoin mining being positioned as competitor to traditional industries for energy use, but has good chance become an ally. Energy crisis pushed EU to its limits, but with energy efficiency being deeply rooted inside the European culture over last two decades there is good ecosystem of tech & human capital that can give boost for new innovations in bitcoin mining sector. Power & thermal management (immersion cooling and heat reuse) need to create more use cases with cross industry deployments and innovations, especially with Power & Utilities sector. Such project will be smaller scale compare to traditional airflow cooling operations, but will be more appealing for investors with clearly defined ESG mandates and targets and make positive contribution for further decentralisation of bitcoin mining.

Who is developing ecosystem? Common condition for bitcoin mining developments across all regions has been that it is miners and never government initiatives leading growth of sector and whole ecosystem. Explicitly not making any reference to regulation, since as of today, there is no single success story globally for bitcoin mining sector improvements being done with regulations. Currently same vicious cycle gets replicated: sector gets established by miners (no government support), setting up initiatives, growth stage and eventually getting supressed. Mainly due to lack of coordination and alignment of governments/regulators with actual bitcoin mining sector stakeholders and establishing proper sector policy dialogue to define rules, conditions to follow and milestones. Hopefully bitcoin mining developments in new regions will take feedback from all “lessons learned” to date for better success stories.

Global bitcoin mining leadership table developments during recent 4 year cycle already gave us unprecedented changes. Some highlight here with more information in relevant Country sections:

Please note that I do not use or make any references to Cambridge Centre for Alternative Finance mapping that still quoted regularly in presenting bitcoin mining regional split, this data was good during earlier days as indication of certain regions but unfortunately doesn’t represent actual hashrate mapping with methodology misaligned with actual sector. Have separate comments added on the subject in next section.

- with China making sudden exodus from bitcoin mining due to local restrictions and pushing hashrate to other regions gave sudden blow to bitcoin haters that used to say “China owns bitcoin”. However, China still plays major role in bitcoin mining ecosystem with full control over mining hardware manufacturing. And this is not going to change anytime soon. Also China might get into have more relax policy on bitcoin mining development in other countries that will benefit manufacturers and be aligned with strategic interest of China. Energy infrastructure is backbone to economic stability and regions that require construction and financing of new power generation capacity. This gives bitcoin mining good chance be anchor client/offtake for power, especially at initial project deployment phases. No industries can instantly go into 100% energy utilisation rate and switch off on request, the same way bitcoin mining does, plus bitcoin mining is self-sufficient doesn’t need to build supply-side logistics that critical and time-consuming for other industries.

- United States managed to show the whole sector how to move from secondary market position in 2019 to the market leader in global hashrate within 3 years. USA was going on good development track until recent developments with DAME (Digital Asset Mining Energy excise tax) that became another confirmation how quickly thing can turn sour. Overall US market has massive potential in terms of energy sources, capital (financial and human) and large community capable to support the growth, but also many in opposition to bitcoin mining especially in the government. Want to make important reference to recent US Treasury De-Risking strategy again that has interesting wording: “By pushing countries and financial institutions to seek foreign alternatives to the U.S. financial system, de-risking may strengthen the influence of our competitors.” So, might sound rather strange hypothesis that statements like “Russia will grow hashrate and take over BTC” and “BTC to fiat on/of ramps will be offered across LATAM in Chinese yuan instead of USD” can do much greater good for bitcoin mining support in USA than 1000s petitions by local community members and 100s experts opinions expressing that bitcoin mining isn’t danger to environment and BTC isn’t main instrument of money laundering. We still to see how situation will evolve in USA as we approach 2024 – year of “Halving & Elections”.

- Fading away of bitcoin mining in “old school”- Nordic regions. European energy crisis reached even furthest areas of Norway and Sweden, with unprecedented rise in tariffs during some months of 2022. In addition, Norway and Sweden rolled out taxes that impacted bitcoin mining operations (especially in Sweden). Prospects could have been better for bitcoin mining up north, in SE1 & SE2, if only Sweden was able to have dialogue with sector players and align with miners to roll out immersion cooling solutions with heat utilisation. In Europe, it is better not to scream too load that you want to set up 20-50MW bitcoin mining operations, might get yourself in trouble before even getting operations online. Regardless of all negative stuff, will remain bullish on European bitcoin mining ability to re-start with more advanced solutions on power & thermal management, which will be main driver for the whole bitcoin mining sector going forward (in contrast to airflow cooling solutions that becoming as red flag and target of environmental and political groups with aim to attack/shutdown sites – at least in Europe).

- Russia silently kept 2nd position throughout last 4-5 years (initially after China and later after United States) and still continued its growth of hashrate. Russian market is more diversified in terms of participants and very active on hardware spot market (compare to USA which is mainly driven by couple of dozen large players with institutional funding and long-term contracts for supply of mining equipment). The Russian market formed by 4 groups:

- Hosting sites that were offering plug & play solution for Russian and non-Russian clients,

- Strategic players that went into mining for self-mining purposes and

- Deep market of retail miners that try deploy 5-20 units with discounted residential tariff;

- Financial investors with goal to convert Rubles into more liquid capital in BTC (stablecoins)

From end of Q3 2022, Russian market has been growing faster than any other region, this was also echoed in media with reference of large volume of hardware being purchased on spot market and destined for Russia. Regardless of Russian government position on how to deal with retail (home miners) & grey mining, the sector has economic importance for the country and allow to redeployment of excess energy. As there is no option to export hardware outside of Russia (legally) any hardware that will be confiscated can be potentially redeployed at controlled sites.

- “Rise & demise” of Kazakhstan, personally would consider as best-case study for bitcoin mining with contrasting ups & downs. Demise started in September 2021, when due to inefficiency in energy sector, energy crisis started on southern region of Kazakhstan (that region was always in deficit). As of now whole Kazakh bitcoin mining market shrank to handful of miners those with new regulation need to choose from small number of locally accredited mining pools and trading platform. Binance is potential candidate for getting large share of business in Kazakhstan. However, with continues build up pressure from USA towards Binance, there is much doubt that any local bank with USD corresponding relationship will take onboard local entity of Binance, unless there will be regional bank that doesn’t need USD corresponding bank accounts and can accommodate local currency on/off ramps.

- “New kids on the block” in LATAM: both Paraguay and Argentina appeared on news over last months as more deployment’s options became available in the region. Here we need to thank Bitfarms as pioneer in discovering new regions in Latin America (first in Paraguay and recently announcing deployment in Argentina). Bitmain recently announced meetup in Paraguay as indication that they see potential market there. Paraguay has excess capacity of hydropower that it exports to Argentina and Brazil. But being sorely dependant on the river as source of energy it has single point of failure in case of draught. Argentina in turn is already experiencing a deep economic crisis and very much dependency on drawing funds from multinational development agencies and banks including IMF with strong anti-crypto position. This week, Central Bank of Argentine announced ban for local banks in dealing with bitcoin (assuming due to ongoing negotiations with IMF which clearly not in favour of bitcoin ecosystem). There is also long-term bitcoin mining veteran – Venezuela, that being key destination in LATAM for used hardware that expected to keep growing its hashrate. With growth in LATAM will allow better liquidity for secondary market (used) hardware in USA that is benefiting from closer proximity for shipment there.

- MENA region getting more attention recently with some announcement of potential projects. In this region will select 3 main countries capable for large scale deployments (and potentially largest hashrate footprint):

- KSA – Kingdom of Saudi Arabia could be viewed as potential destination for bitcoin mining and has all resources (energy, financial, regulatory) to establish ecosystem in the country.

- Iran had the largest footprint in bitcoin mining in MENA region but there is no information or any confirmation re Iranian hashrate as of today.

- Iraq has been a country that went through a major turbulence and has not been a focus for Bitcoin mining. At the same time Iraq has a huge potential with utilising of gas flaring sites

Global Bitcoin Mining / Hashrate Map: key regions & commentary

Just to make most simple map for now with only Established and New markets, this section is more focused on transparency and representation methodology of the bitcoin mining market.

Do not use popular quoted mining map by Cambridge Centre for Alternative Finance (CCAF) as it doesn’t pass reasonableness check. since methodology used in CCAF mapping has reference to IP addresses which does not represent valid stats just for example information for Germany have more hashrate than Sweden and Norway combine, this is major flaw already seen in the data but also need to understand sector specifics.

Important to understand that difference in visibility for some bitcoin mining regions is due participants in those regions being more vocal about their development, including proving more disclosure and transparency. The bitcoin mining sector has been evolving at high pace (comparing to other traditional sectors), with some sector traits inherited from earlier phase of evolution of bitcoin mining. During earlier days when wider transparency created more risk for operations & (maybe) owners. Hence, mining quietly doesn’t automatically qualify as criminal activity, but could be local business culture and no need in active marketing.

This brings us to availability & reliability of datasets re ranking and mapping within bitcoin mining sector. Initial coverage of Cambridge Centre for Alternative Finance (CCAF) was used as popular reference across media and various research, as most reputable source information at the time. However, it gave result only as good as someone in specific region or provider wanted to share / or not share information. China and Russia were never very interested to disclose operations – since both countries had strict local policies and enforcement agencies.

Growth of investors’ interest (especially with excess liquidity from USA) being major catalyst for transparency, as capital providers expected for teams, projects and sector in general to come closer in line with proforma disclosure requirements and set a good industry practice on reporting. USA through Foundry and Luxor pool has good set of data for North American mining.

But only challenge remains on how to get any sufficient level of transparency for hashrate from other regions at least on number of MW deployed. Will not expect for example Russian government to push into full transparency on hashrate, as it will automatically set local miners, pools and custody as targets for potential sanctions and further tracking. But as sector gets under closer supervision, will expect more official stats being released.

NORAM: North America

USA

Until recently USA has been the most dynamic market in terms of speed, size and quality of developments and support bitcoin mining environment: with diverse sources of energy, availability of institutional capital, self-sufficient internal ecosystem in terms of banking, trading and custody as well as servicing large number of non-US clients and acting as main backbone for BTC/USD settlement – this was also strong competitive advantage of US for bitcoin mining clients and digital assets ecosystem in general.

During last few months and especially weeks, the whole industry was shaken by squeezing on/off ramp by hasty liquidation of established banking providers and pushing the whole sector at mercy of traditional banking. Also, negative news came with DAME (Digital Asset Mining Energy excise tax) initiatives to put additional tax on bitcoin mining, this will definitely put on hold investment decisions for new developments.

But still see banking in becoming main bottleneck for the sector in 2023. There will be more action in coming months that will have further impact on banking (inside and outside US) with requirements proposed via US Treasury De-Risking strategy … reference worth noting that….”correspondent banks need to have a certain volume of transactions from the respondent bank to justify the costs of maintaining the relationship.”. These already indicates that will narrowing down capabilities for cross boarder payments and will not get easier for digital asset ecosystem especially on cross border settlement in fiat currencies.

Seems that the only “defence” could be through “geopolitical concerns”… this statement in the de-risking strategy good reference to it: “By pushing countries and financial institutions to seek foreign alternatives to the U.S. financial system, de-risking may strengthen the influence of our competitors.” So, might sound rather strange hypothesis that statements like “Russia might get control over bitcoin mining with more deployments” and “BTC to fiat on/off ramp will be offered across LATAM in Chinese yuan instead of USD” can do much greater good for bitcoin mining development in USA than 1000s petitions and 100s experts opinions stating that bitcoin mining not so dangerous for environment. And with loosing share in BTC/USD settlement flows, USA will be diminishing its leadership position.

In terms of future potential for bitcoin mining, there is larger pipeline for developments as US market has massive potential in terms of energy sources, capital (financial and human) and large community capable to support the growth, but also many in opposition to bitcoin mining especially in the government. We still to see how situation will evolve in 2024 year of “Halving & Elections”.

CANADA

Canada was one of earlier pioneer (together with Nordic region) in building up transparent bitcoin mining sector. During 2017-18 Toronto stock exchange became a main platform for companies transitioning in capital markets via RTO (reverse take overs). Canada can be proudly positioned as main stepping block for transition of bitcoin mining into capital markets.

Canada had big traction of interest for new deployments over the years and managed to build ecosystem for bitcoin mining companies across different provinces. However, like in many other countries, 2022 was challenging year due to energy crisis. Over last months there were mix position voiced from some provinces like Manitoba paused few new deployments due to high local energy demand, Ontario proposed initiative earlier this year to exclude crypto miners from an incentive program and Hydro-Quebec stepping in with higher rates and usage limit for bitcoin mining mainly due to energy demand and pressure on aging network.

If Canada will not impose any major restrictions for bitcoin mining, we should still see Canadian hashrate maintaining further growth, but will not expect large new projects being approved especially after news coming out of USA with additional taxes and restrictions (such position might be mirrored by some Canadian politicians for own agenda).

EMEA > EUROPE:

ICELAND

Iceland is self-sufficient in geothermal & hydro energy supply and has no obligations for export energy and therefore had no exposure to turbulence that was seen in European energy market last year. It is also most neutral country with no exposure to current geopolitical environment and safest location for bitcoin mining (but there are limitations). New capacity has not been built for over 2 years and only option to get hosting via replacement of existing capacity (i.e if older miners getting disconnected and client decides to leave). Such availability did appear for a short period of time in December 2022, post FTX event with BTC price falling towards $16k, that forces some mining operations with older generation of hardware going into shutdown.

But there is more competition for space, as Iceland popular with traditional data centres this means any spare capacity is in high demand. This became more apparent especially with changing weather conditions, like heatwave that hit London in July 2022 and resulted in shutdown of some data centres (including one of Google), this sparked more interest for data centers in Iceland as well as Norway and Sweden. Therefore, priority is naturally given to traditional data centres for any new deployment (or redeployment of capacity). Also, some data centres have internal requirements from their investors to give preference to traditional sector clients rather than bitcoin mining clients, as it is more appealing for portfolio composition of data centre REITs.

With no new capacity being build and replacement of bitcoin mining hosting with traditional DC clients, Iceland will see gradual reduction in hashrate going forward.

NORWAY

Norway is self-sufficient in energy supply and has export agreements with EU and UK. With Europe undergoing major turbulence in energy market last year, Norway southern regions have been hit hard with skyrocket rise in energy tariffs. This led to shutdown of all bitcoin mining operations in southern regions (NO1 & NO2), with exceptions of northern part of Norway (NO3 & NO4). Few miners managed to get relocated, but some felt into liquidation.

In 2023 energy tariffs had some recovery, but difference between north and south is still significant. For comparison, average tariff on Nordpool for Jan-Apr 2023 was EUR 0.105/kWh in the south (grid fees not included) which was 65% higher than on the north (during 2022 tariffs were even more dramatic).

Additional blow to bitcoin mining sector was abolishment of tax preferences for data centres that ended in 2022. This further limited option for any new developments and put pressure on some less efficient operations. Some link tax increase not to climate initiative, but power struggle in balancing between interests of north & south regions especially in very contrasting energy tariff difference, as well as, putting pressure on energy firms. Overall bitcoin mining tax revenue is completely marginal for the country. Norway’s sovereign fund is second largest after China’s CIC and traditional oil & gas as key revenue generating industry.

Shake up post 2022, still offering opportunities for bitcoin mining in Norway with some potential for M&A, restructuring of distress assets and very selective options for mid-size deployments preferably with immersion cooling (those will be viewed as sustainable operations and without noise pollution that exist from airflow cooling – which later becoming common tool to shut down operations).

SWEDEN

Sweden is self-sufficient in energy supply and has export agreements with other EU countries. In Sweden situation developed almost synchronically to Norway, but with more drastic effect. Energy crisis put more pressure on Sweden due to support of neighbouring regions. Finland was disconnected itself from 1 GW Russian nuclear energy supply and as of now hasn’t started its own new nuclear powerplant at full capacity, plus Germany was in urgent need to find replacement for Russian gas and shortage of supply from France (as 30% of French nuclear capacity went on maintenance in 2022).

Same time as in Norway, the discussions started with initiative to abolish tax preferences for data centres, which resulted to tax increase that is almost double of those in Norway. General energy tariff for north Sweden (SE1 & SE2) have been higher than Norway (NO4). For comparison as per average price at Nordpool for Jan-Apr 2023 tariff was EUR 0.055/kWh (grid fees not included) for north Sweden and EUR 0.038/kWh for north of Norway (during same period tariff for south of Sweden was EUR 0.083/kWh).

Similar to Norway there is contrasting distribution of pollution between north and south. Many places up north have no sufficient infrastructure to accommodate large factories. In order to have factory with 200-300 people, with family members it need to be approx 500-750 inhabitants in remote location, one need to prepare infrastructure, residential buildings to accommodate people with families, sufficient capacity in terms of hospitals, schools other support services. Depending on what such factory will produce, also need to establish supply routes for raw materials and shipment of finished goods. All of this will require more resources in terms of capital and time, compare to bitcoin mining that can be deployed within months and very self-sufficient as long as there is energy supply, internet connection and local personnel to work in operations. So the question remains what is feasible and realistic. But still political narrative for anti-POW occasionally referring to bitcoin mining using green energy of Sweden that could have been used instead by traditional sectors that try to meet their climate objectives.

Prospects for bitcoin mining development in Sweden is bleak. The business model of hosting providers and broker type of services to be eliminated from July this year when additional energy tax kicks in. The only viable option will remain in Sweden with self-mining (not hosted model). Also, further initiatives for use of immersion cooling with heat utilisation will bring new life into bitcoin mining potential in Sweden and transformation from airflow cooling into immersion cooling infrastructure in the region.

Nordic region countries have higher density of population & number of enterprises based on south leading to higher demand for energy and higher tariffs. North has lower tariff due to excess energy capacity and very low population base.

On general note, population of northern regions have large representation of Sami people – indigenous group that live across northern parts of Sweden, Norway, Finland and Russia with own strong community presence.

FOR REFERENCE: European day-ahead-flows MWh as per information from Nord pool as of 30 Apr 2023

Nord Pool runs the leading power market in Europe, offering both day-ahead and intraday markets to its customers. https://www.nordpoolgroup.com/en/maps/#/nordic

Map has an outline of interconnect shows energy interdependency within EU. Lines without numbers on right site towards Russia and Belarus has not been used from March 2022.

RUSSIA

Russia is self-sufficient in energy supply and has export agreements with China (no longer with EU) and seem that increasing footprint in Central Asia. Prospect for more mining capacity high. Bitcoin mining will generate taxes, import duties, deployment of underutilised energy infrastructure. Next Presidential election in March 2024.

Russian bitcoin mining sector probably was the most silent over last 4-5 year, but at the same time persistent in growing hashrate. Important to understand that after China exodus from bitcoin mining, the only two countries have access to sizable & diversified energy sources for taking top position in hashrate are USA and Russia.

The Russian market formed by 4 groups:

- Hosting sites that were offering plug & play solution for Russian and non-Russian clients,

- Strategic players that went into mining for self-mining purposes and

- Deep market of retail miners that deploy 5-20 units (with discounted residential tariff)

- Financial investors with goal to convert Rubles into more liquid capital in BTC (stablecoins)

Retail and Financial investors groups until recently being very active groups for secondary (used) hardware market. Hosting sites operate with clients sending hardware (new / used) or hosting provider offer procurement service (similar model exist in USA, Canada and Europe). Strategic players is harder to identify as they don’t need (and don’t want) any marketing and only occasionally information can surface among brokers / distributors network about large purchases being made or shipped.

The reason for growth of retail segment was mainly due to subsidies that exist for residential tariffs vs commercial use (4-5 times lower) – tariff approx. $0.02/kWh for residentials. Hence, it became popular tool to run few miners at home in some (especially cold) regions, but over last few months Russian government tried to localise and shutdown illegal and home mining. Home mining is treated as commercial use of energy and should be hosted in specialised location with business registration and different electricity tariff. Also, home mining activity is not fully compliant with health & safety norms, and there were instances of fatal accidents (people heating up their sauna / swimming pools and burning down houses due to overheat or wiring issues).

Prior to February 2022 events, some Russian bitcoin mining players started actively building their international profile. Bitriver being the biggest and most advanced hosting provider in CIS region at the time with diversified client base (including some top names in crypto space from USA, Europe, Japan, Korea, China). However, in March 2022 sanction hit Bitriver and situation changed significantly for Russian bitcoin mining sector – especially with hosting of western clients, those started searching for options to withdraw from Russia but unsuccessfully in many cases. Sanction initially created panic, but due to geopolitical shifts, there was change in profile of client origins that willing to host in Russia. With current USD/RUB rate, ruble based tariff provide competitive hosting in Russia for clients that ready to accept risk of sanction region.

Sanction did put extreme pressure on banking support for Russians inside the country due to shutdown of corresponding bank relationships and limited ability to make payments outside of Russia, this pushing more people inside Russia to look for ways to convert their ruble-based capital into liquid non-fiat (USD or EUR) alternatives such as in BTC and stablecoins. Bitcoin mining could be a tool for dealing with capital flow control (spend rubles and get BTC). This is similar to situation that annoyed Chinese government for years when bitcoin mining was used as rails for getting local yuan converted into BTC through mining.

However, Russian government is taking active steps in creating oversight of bitcoin mining and pushing for developments in regulation. Seems that it is clear for the government that bitcoin mining generates healthy environment with collection of:

- import duties (law enforcement agencies were actively chasing grey import of mining hardware into the country already for a year)

- bitcoin mining generates additional revenue for Power & Utilities companies that had reduction in demand for electricity due to economic downturn mostly driven by sanctions.

- additional investments into upgrading energy infrastructure. There are initiatives under review to divert bitcoin mining to regions with excess capacity of energy. One such region is North West that has similar conditions to Sweden and Norway with over 1GW capacity that before February 2022 was supplied to Finland.

- additional tax revenue with more strict rules will apply for illegal mining to fast-forward conversion of sector into maximum transparent level for state authorities.

- set up local market for BTC / Ruble conversion. this is most likely scenario that BTC will be allowed for sale only via local accredited/controlled exchanges, and all digital assets to be held on wallets registered with tax authorities.

- Allow use of BTC for international payments by businesses. Here is more likely scenario that this will refer to mid-size business that were hit hardest due to sanction and unable to operate with counterparties outside of Russia due to banking restrictions. There could be similar platform to the one starting now in Iran. (Sorry to disappoint, some bitcoin critics, by saying that Russian large enterprises and Oligarchs do not use bitcoin to move capital due to its transability and other fiat-based payments available within multipolar environment)

- Human capital growth – bitcoin mining ecosystem in Russia over last 5 years managed to raise significant number of technical specialists for software and hardware (microelectronics) developments.

From end of Q3 2022, Russian market has been growing in faster dynamic than any other regions. There is structural difference between USA and Russian bitcoin mining market. USA being mainly dominated by couple of dozen players with institutional funding and long-term contracts for supply of mining equipment. Russian market is more diversified in terms of participants and very active on hardware spot market (not long-term contracts). With current events unfolding in USA bitcoin mining space, Russia will be only country able substantially accelerate hashrate growth. Regardless of Russian government position on dealing with retail (home miners) & grey mining, the sector has economic importance for the country. Since there is no option to export hardware outside of Russia any hardware that will be confiscated can be potentially redeployed at controlled sites.

Russia will be able to extend its support to Central Asia through energy supply. This could allow for neighbouring countries like Kazakhstan to “resurrect” its hashrate within fast timeline as infrastructure was already build.

The main challenge we have for mapping Russian hashrate is insufficient level of transparency for hashrate origination inside the country. Will be already sufficient if Russian government sets up reporting metrics, at least, on MW deployed. Will not expect to push into detailed transparency on hashrate, as it will automatically put at risk local miners, pools and custody providers as potential targets for tracking and sanctions.

CENTRAL ASIA

KAZAKHSTAN

Kazakhstan is self-sufficient in energy supply and has import/export agreements with Russia and Kyrgyzstan. However currently any hourly deficit within Kazakhstan grid is compensated by Russia. Also Russia takes on transit of electricity to Kyrgyzstan and can cover full deficit for electricity if Kazakh grid network will be updated to transport it.

Kazakhstan has best-case study that gives within 5 years full cycle of “rises and demise” in bitcoin mining. There was significantly reduction in operations from summer 2021, but bitcoin mining still continues on few large sites in north-east of Kazakhstan and few operations on west of the country with off-grid with gas as source for energy generation.

Back in 2017, the country had significant excess of capacity in north-east region (note that south was always in deficit). This was time when first data centres for bitcoin mining started their developments in that region. Some of those early bitcoin mining players made highest contribution in establishing Kazakhstan profile as business friendly, transparent destination for bitcoin mining and development of ecosystem in the country.

Focus was to build industrial scale business with right corporate and operational structures within local ecosystem that will allow for bitcoin mining being recognised as new sector suitable for Kazakh economy. For engagement in policy dialogue, Data Centre Industry & Blockchain Association of Kazakhstan, was set up and started operations from January 2018. A lot of knowledge transfer was done over the years for development of bitcoin mining sector, with specialist flying in from all over the world. This included visits to Sweden to learn how date centre ecosystem started evolving there after collapse of Metals& Mining in 2007-08 crisis. Data centre infrastructure was cleanest solution for utilising excess capacity of electricity and creating additional value added for local economy (rather than just exporting “basic tariff USD pre kWh”. This also leads to emergence of new ecosystem with support services. This was original vision for Kazakh bitcoin mining sector: establish data centre infrastructure in remote areas that also created value added locally (where it is typically challenging to set up new factories as it requires significant FDI – Foreign Direct Investments).

It is important to understand when people talk about bitcoin mining done (in most of countries) it is not actually constituting full cycle from miner set up and hashing on the shelf to final BTC liquidation and fiat settlement.

Bitcoin mining consist of two components:

- infrastructure (secure date centre with power supply, ISP connection, installed mining hardware and cooling with maximum accessible uptime) and

- commodity trading of hashrate / BTC (tracking hashrate origins > mining pool > liquidation and conversion BTC to fiat).

In many countries on global bitcoin mining map (including Kazakhstan until recent changes in regulation) only infrastructure component (1) is located inside actual country, but commodity trading (2) is done within jurisdiction where ecosystem capable to support digital assets including trading, custody and access to crypto friendly banking. Popular location for miners from Europe and Central Asia historically were Switzerland or Singapore.

Kazakhstan already in 2017-18 was in unique potion with special economic zone established – Astana International Financial Center (AIFC) which is similar to Dubai special economic zones (with English law and mandate to develop new initiatives in fintech & digital assets). However, there was one big problem (that still not resolved) …banks or at least one bank that can service crypto clients. This could have been initially just one bank that could service only legal entities registered within AIFC (not retail clients in Kazakhstan – because as we all know, dealing with retail clients will bring “lightning thunders” from local central bank and regulator). Very unfortunate that this vital component has being delaying developments of digital asset ecosystem in Kazakhstan.

With regards to trading platforms, there are two global players that pivoted into Kazakh special economic zone: Bitfinex Securities came to explore opportunity last year. Another player is Binance. Interesting that Binance actually could have stepped in back in 2018-19 but at that time Kazakh market was too small, but global landscape changes and Binance saw licence within Kazakhstan AIFC as prime aim to allow setting up on/off ramp for crypto to fiat / CBDC (there is announcement of Binance with National Bank of Kazakhstan for deployment of CBDC). Also, Binance explore offering wider range of products/services including mining pool, that according to new Kazakhstan regulation for bitcoin mining need to share information with tax authorities. This is also likely to allow Binance in taking lion share of trade flow for locally mined BTC – it is requirement that all Kazakh based miners sell 50% of BTC mined locally from 2024 and 75% from 2025). The only question remains, what bank will support such on/off ramps or will Binance build BTC to CBDC rails under National Bank of Kazakhstan supervision that allows for digital assets ecosystem to evolve (if CBDC be eventually allowed for payment in Kazakhstan).

Coming back to Kazakhstan bitcoin mining, the demise of sector started September 2021, when due to inefficiency in energy sector, energy crisis started with problems in southern region of Kazakhstan. The easy target to blame was bitcoin mining sector, news references to Chinese miners migrating to Kazakhstan was an easy narrative to apply. Just to put it into perspective: before China shut down its mining, Kazakhstan was already established destination for bitcoin mining and most of capacity that was available i.e. didn’t require major capex was already used or in developments phase. So, it is not like, Chinese miners came overnight from China, installed their hardware, connected to the grid (without anyone noticing energy drawdowns) and took down the whole grid…What was likely cause of problem on the south region was: i) questionable reasons why mining was allowed to connect in the region that has permanent deficit, ii) illegal / grey mining that was taking place since this region was main transit route for hardware out of China. iii) one can make assumption that there could have been some level of corruption that led to some mining hardware finding its way (not fully legally across the border) and grey bitcoin mining being deployed in the south region. Such influx of illegal mining could have added pressure on already stressed local energy grid.

The biggest disaster for official (white) miners was shut down from September 2021 until April 2022, with only limited / partial capacity operational and getting through this period. Official miners invested into infrastructure and officially imported hardware. With new tariffs for bitcoin mining its stopped being economically viable for many players to continue operations & new deployments and many decided to move to USA and some to Russia.

Bitcoin mining still continues in Kazakhstan now but on much reduced level. This will be tough competition for any pool in fight to get a business from miners, unless additional services are offered like with Binance.

With continues pressure building up for Binance in US, question arises what local bank in Kazakhstan, with USD corresponding relationship, will able to provide banking services to Binance local entity. Unless it will be regional bank that support regional flows and doesn’t need USD corresponding bank accounts and will be out of reach.

In addition, should add that external pressure building up for Central Asia countries for facilitating trade flows and transportation corridors for Russia. USA already warned of potential secondary sanctions against Kazakh banks and companies for continuing cooperating with Russia. This raises additional country risks for Kazakhstan.

But seems that region is drawing own agenda and Russia is increasing supply of electricity through Kazakhstan to cover deficit of Kyrgyzstan. Potentially Russia can increase supply directly to Kazakhstan to meet demand for bitcoin mining infrastructure that stays is idle mode after shutdown and can be quickly put back into operations to bring Kazakhstan back in league table for bitcoin mining.

REFERENCE PAGE to highlight importance of interdependence among regions across Russia / Central Asia please see 2 diagrams

FOR REFERENCE: Diagram of network of 1150-500-220-110 kV powerlines of Kazakhstan

FOR REFERENCE: Diagram of network of 500-220 kV powerlines of Central Asia

UZBEKISTAN

Uzbekistan had some positive initiatives for development of digital assets ecosystem with first 2 licences issued for local exchanges buying and selling cryptocurrency, which should be viewed more as a sandbox for potential future deployment of CBDC (whenever regulator and Central Bank be ready for such initiatives).

In terms of Bitcoin mining the initiative from The National Agency for Perspective Projects (NAPP), the country’s chief digital assets regulator, was to allow mining only by firms using solar energy to stimulate investments into renewable energy generation. It is very unlikely that bitcoin mining will get any support locally as it will be competing with demand from local industries that have being expanding.

Therefore, will not expect any meaningful bitcoin mining hashrate building up in Uzbekistan, but should not exclude that minor retail type of mining can randomly take place across the regions and very likely be targeted for shutdowns as demand for energy increases.

KYRGYZSTAN

Kyrgyzstan is a naturally rich region with hydro power, however as most of infrastructure and grid was built within unified Soviet Union energy system, there is interdependency between different countries which used to be part of one big energy system before. Kyrgyzstan dependant on interexchange with Kazakhstan. Russia recently taken decision to transit electricity to Kyrgyzstan via Kazakh grid and can cover full deficit of electricity in Kyrgyzstan if Kazakh grid network will be updated.

There is ongoing circulation of information that some bitcoin mining taking place in Kyrgyzstan, but according to Deputy Minister of Energy of Kyrgystan Mirlan Jakypov there is no (legal) bitcoin mining in the country and this is not needed until the time Kyrgyzstan gets through energy crisis. So mostly likely that many operations that still in the country are on operating on grey (illegal) mode. The government was actively chasing to shut down all illegal mining last year.

Potential developments for bitcoin mining expected are negative (bitcoin mining is competitor) due to state of energy market and priorities of the government for use of any excess capacity for traditional sectors and residential needs. Even if the government will have a change in strategy and allow bitcoin mining, any new deployment will be economically unviable ahead of bitcoin halving and hence doesn’t contribute to tax revenue.

MENA:

KINGDOM OF SAUDI ARABIA (KSA)

KSA could be viewed as potential destination for bitcoin mining and. The region is clearly having significant energy resources as well as financing capital to establish operations within the KSA. Any such operations need to address specific weather conditions to remain sustainable, as well as, maintain locally team of technical experts to support operations especially in mid-term.

The Saudi Arabian Monetary Agency (SAMA) has been working with the Capital Market Authority (CMA) and the Saudi Arabian General Investment Authority (SAGIA) to develop regulations for digital assets.

Recently Saudi Arabia also announced launch of special economic zones with focus on advanced manufacturing, cloud computing, medical technology and maritime. Cloud Computing SEZ could become a hub for new projects pivoting into development of more technologically enhanced bitcoin mining operations with immersion cooling and heat reuse potential.

With Oil & Gas sector being core of KSA economy there are opportunities for integration with oil & gas sector for potential utilisation of flammable gas. Will not expect KSA accepting utilisation of energy resources for any airflow-based solutions.

In general bitcoin mining deployment can be primarily driven by institutional type of funding for industrial scale operations in KSA, which could potentially add KSA to global bitcoin mining map.

IRAN

It is expected that Iran had the largest footprint in bitcoin mining in MENA region. There is no information or any confirmation of hashrate from Iran but there were few media coverage Iran’s about bitcoin mining sector. Also information from the market for older generation / used mining hardware relocating to Iran. There were also news indicating that Iranian government was shutting down illegal mining operations across the country.

Iran has excess capacity of cheap energy and together with sanctions and significant capital flow restriction, creating combination where bitcoin mining can become a tool to generate alternative liquid assets (BTC) by utilising excess energy. Recently Central Bank of Iran (CBI) allowed local specialized platform to connect local companies that want to pay foreign suppliers with digital coins.

Will expect that this region could have further grow potential, especially now when hardware prices at their lowest point (especially for second hand hardware). But not expect to see Iran releasing any information on its hashrate for us to formulate global hashrate statistics, so only reliance on information available is from resurfacing through market sources or media.

IRAQ

Iraq has been a country that went through a major turbulence and has not been a focus for Bitcoin mining. At the same time Iraq has a huge potential with utilising of gas flaring across multiple sites. But to roll out such a challenging venture, one need guts & skills to balance within Iraq turbulent environment among: military and oil & gas groups, geopolitical interests, effective project management with expat team on the ground, keeping own operations & personnel safe.

Closing of gas flaring sites contribute to real ESG score and gives large credit for dealing with gas flaring crisis that already indicated with link to cancer. Part of energy generation can be used for small local communities. If “all stars aligned” this could be one of big regions for bitcoin mining in the future.

AFRICA

Northern Africa (Algeria Morocco Libya) count potentially possess opportunity for development of Bitcoin mining with energy resources that countries possess, however due to energy crisis in EU and large dependency on alternative supplies, it is very likely that any developments in bitcoin mining will be highly opposed from EU. So don’t see that any project will be able to go live if it can be positioned as competitor to European households and depriving European consumers of cheaper energy sources.

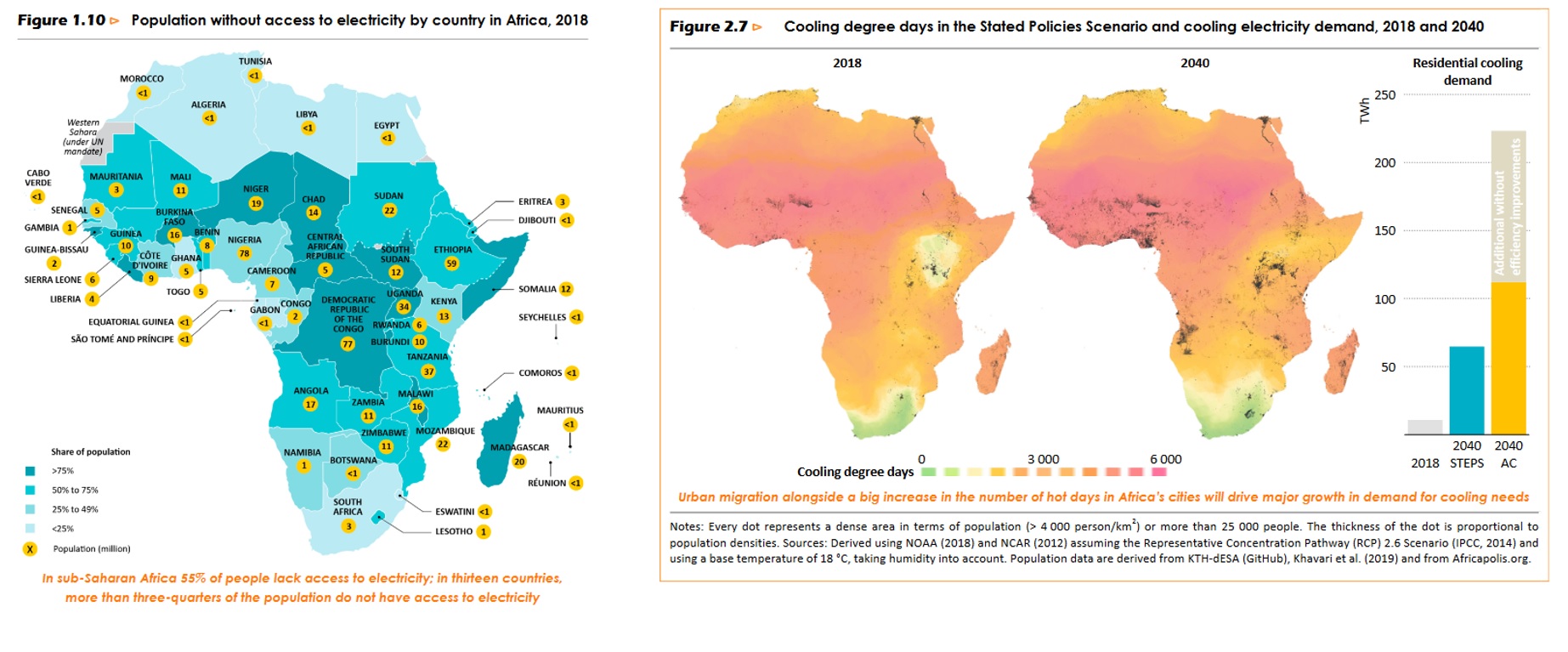

To show prospectives for developments in Africa would like to precent two extracts from International Energy Agency – Africa Energy Outlook 2019 showing population without access to electricity and another showing one of drivers for energy demand – cooling systems. This identifies that energy is basic need that people in Africa and therefore any competition from bitcoin mining will be unacceptable, unless the project if replacing financing from traditional Multinational Development Institutions like ADB and IFC and self-fund new generation with partial use of energy for bitcoin mining.

Kenya and Nigeria are two regions that appeared through some projects leads and discussion within market with potential for bitcoin mining developments. These countries can have development potential as they have no exposure to energy transit to Europe and can grow their own energy generation capabilities where bitcoin mining can be one of anchor clients.

APAC

CHINA

China was historic leader in bitcoin mining, hosting, mining hardware manufacturing and distribution. Major problem for Chinese government was that bitcoin mining was used as instrument for bypassing capital flow control i.e. Chinese yuan inside the country could be converted into BTC and stablecoin, to be used as liquid means of payment outside of China. This could have been one of triggers that led government in putting a stop to bitcoin mining overall. Some may remember the approach China had in dealing with forex and gambling sectors earlier in 2000s – it’s all about people moving capital, bitcoin mining showed similar pattern. Also, some operations might have been evolved with corruption on local municipal level, that government has being targeting as well.

Important to note that China drastically reduced mining and some say that it went to zero, but will doubt it. It is definitely the case for hosting/cloud mining and servicing retail clients (Chinese and foreigners). Such cloud hosting sites were visible on the market and clearly had to be shutdown and relocate (if possible). Some larger groups relocated to USA and other regions. Unfortunately, we will not be able to validate hashrate footprint for China, but expect that bitcoin mining still exist for few selected groups that don’t need to market themselves to attract clients or investments (i.e self-mining).

But China still plays major role in bitcoin mining ecosystem with full control over mining hardware manufacturing. This will not change anytime soon. This actually might create risk for US based operations, if there will be enough support within the government to use “China controlled manufacturing” as another anti bitcoin mining tool (for example claiming that USA investment should not support Chinese manufacturers). As a result, we might see mining hardware production and distribution diverting to other regions which in current multipolar environment are more friendly towards China. But this will also trigger to reenergising idea of potential US produced bitcoin miner, which is very unrealistic at present…so far only real option was set up of assembly lines in USA, which was done by MicroBT (thanks to real business vision of Foundry/DCG leadership in supporting this).

China might also get more relax view on bitcoin mining development in other countries that will benefit manufacturers and be aligned with strategic interest of China in such regions. Energy infrastructure is backbone to economic stability and regions that require construction and financing in developing new power capacity can have bitcoin mining as anchor client/offtaker, especially at initial deployment phases – can repeat same statement, that no industries can instantly go into 100% energy utilisation rate and switch off on request, the same way bitcoin mining can, plus bitcoin mining is self-sufficient in the sense that no need to build any supply-side logistics that critical with other industries.

So, China is out of bitcoin mining at home, but indirectly remains in bitcoin mining via manufacturing and could have more friendly position on bitcoin mining in regions with own economic interests.

BHUTAN

As called in one of our post: Bhutan “butterfly effect” in bitcoin mining continues… Bhutan until recently was never on global bitcoin mining map and only after recent article by Forbes Iain Martin & Sarah Emerson it became more visible (but nothing still confirmed officially actual hashrate, even with last video release with DHI comment). For such a small country having already links to BlockFi, Celsius, Bitdeer, $140m worth of imported hardware representing 10% of the country total import and no official disclosure from DHI (Bhutan sovereign fund) with regards to numbers for FDI / bitcoin mining exposure. All of these raises more questions and further interest in the story… Lets say: transparency reduces grounds for conspiracy. So will look forward to further statements form DHI. Until we see more information about actual bitcoin mining in Bhutan, it should not be added to any global stats and maps. And from what is seems, Bhutan doesn’t need to have bitcoin mining to boost its economy via additional tax collection, but it does need Foreign Direct Investment to build up Power & Utilities infrastructure in order to create assets that will give more stable cashflow for the country and people of Bhutan. Bitcoin mining however, can be key anchor client/ offtaker for energy at early phase of deployment, with potential phasing out as other energy users be added.

The question who will have economic and political interest in such developments (including financing). Important to note that Bhutan historically been in challenging position to balance between very sizable and powerful neighbours China and India (just google Doklam Plateau dispute for additional reference).

MONGOLIA

Mongolia has almost zero visibility with regards to actual bitcoin mining operations in the country. Couple of years back Mongolia got some media coverage as Chinese miners were moving into new regions. With initial large coal deposits in the country, it had options for utilisation some of excess energy capacity for bitcoin mining but as many regions it had energy crisis. So don’t expect any developments in Mongolia but further reduction of what is still left there, as government was shutting down many illegal sites.

INDONESIA

Indonesia had some initiatives for bitcoin mining to join wave for development of digital assets ecosystem, but due to the fact that country is dependent on fossil fuels and priority to energy use for large population base, it is unlikely that any sizable deployment of bitcoin mining be allowed and be taking place in the country.

However, bitcoin mining sector can participate in co-financing construction of new power generation capacity in the country. But this will require substantial coordination work, in order for bitcoin mining investor/project to be aligned and accepted as participant in any syndicate financing. Such financing typically done alongside traditional multinational development banks – MDB and utility/infrastructure sector investors. Due to position of MDB towards crypto businesses, it is very unlikely that joining such syndicate be allowed, therefore only option will be for bitcoin mining participation to group syndicate financing from investors active in digital assets space or have no allergy to have exposure to crypto related counterparties and partners. But challenge doesn’t end here, next will be banking support/corresponding banks since all project work will be fiat funded. This brings us back to recent US Treasury De-Risking Strategy that will be very much focused on narrow passages of global capital flows – corresponding banks that can represent high-risk cross-border corridors (with mix of crypto / fiat investors is it likely to be additional difficulty to get banking relationship). Bitcoin mining prospects in Indonesia are low.

MALAYSIA

Malaysia had substantial influx of illegal mining over last 2-3 years and government was actively identifying & shutting them down. Here it is once again important distinguish between real bitcoin mining and theft+corrupton that facilitates use of bitcoin mining for criminal activities. Clearly Malaysia has some activity in the country and this puts in question how real is the number of actual hashrate footprint on global map presented with dataset republished references from survey data. If we look at actual announced raids on illegal mining sites in Malaysia, the typical illegal site is 100 – 400 miners that being sized. It is indication of retail segment where households try to steal electricity and get extra revenue via mining. However, nothing significant being identified to date in terms of large-scale operations in Malaysia.

With recent energy crisis, growing demand for energy with growth of population and energy strategy shifting from fossil fuel to gas supply, we will not expect Malaysia putting bitcoin mining as real market participant, but more likely to be seen as competitor. Therefore, don’t expect any major development in bitcoin mining in the country.

LATAM:

VENEZUELA

Venezuela being very active in bitcoin mining over last years, however there is not much information available about size of actual hashrate and only based on market insides. During 2019-20 information was circulating that mining sites were identified and hardware sized by pro-government entities. Bitcoin mining sector has been under centralised control with number of hosting sites operating for external clients. Over last couple of years, “through market whispers”, it became destination for hosting of older generation of mining hardware. Many of those old S9 found new life in Venezuela after exiting China and Europe. Nowadays Venezuela benefit from close proximity to North American market for secondary hardware sales, as it is more convenient to ship from US.

Recently local politics doing through phase of investigation for corruption surrounding PDVSA (Petroleos de Venezuela, S.A., the national oil and gas company) and SUNACRIP (The Superintendencia Nacional de Criptoactivos, national institution covering cryptocurrency related activity, including bitcoin mining). Both entities become closer connected through initial coordination work to address effect of sanctions. From that time bitcoin mining became means of utilising some of excess energy capacity plus generating liquid assets from operations (which in some instances better form than fiat). In sanctioned countries with strict capital controls any bitcoin mining operation allows to create pool of liquid resources inside the country that can also be used for other business or political needs. Therefore, any government want to have such activity under control at home.

Bitcoin mining addressing two basic needs: utilisation of surplus of energy and freedom for capital flow/allocation. Such bitcoin mining crypto flows are not part of some major strategic instrument for Venezuela to facilitate international trade under sanction, but more to serviced needs of local groups. For facilitating foreign trade flow other platforms are used. Will need to observe developments of platforms used in Venezuela, Iran and Russia which are either already or eventually will have harmonised system for trading and settlements in crypto for goods sold by those countries.

Current ongoing corruption investigation in Venezuela resembles more of a routine power rebalancing within a country, where one internal group has being growing stronger because it had access/control of certain assets and now their management control had to be “restructured”. Regardless of outcome of this investigation, expect bitcoin mining remain with further developments on the way. Some current hosting clients may have their mining equipment repossessed as being affiliated with people under investigation (but doubt that many of those foreign hosting clients had anything to back up real ownership to hardware in the first place).

Venezuela to continue growth of bitcoin mining footprint and should expect to go for “hardware upgrade” and procure for new / used stock of hardware (as market is flooded with stock).

EL SALVADOR

El Salvador probably got the biggest support from bitcoin community for initiatives in supporting ecosystem and making firm position with decisions on certain policies that not welcomed by global institution such as IMF with regards to bitcoin adoption. Another criticism for El Salvador president was from human right groups in handling situation with prisoners that are part of large organised crime groups. This is very bold move by El Salvador President and very likely had highest level of urgency. In many cases such criminal groups create instability inside the country and can become instrument for other geopolitical interest groups in forming instability especially it might correlate with local elections and potential powershift in local government (btw, elections in El Salvador scheduled for February 2024). Was this right approach or not is hard to judge from outside, most important is the result for El Salvador as nation and its government in maintaining stability in the country.

Coming back to bitcoin mining, there were no major progress made yet in El Salvador. The country has good geothermal resources, but getting project off the ground is complex process: geological surveys, feasibility studies, permits, drilling, environmental assessments and most important financing. As already mentioned with reference to other countries, bitcoin mining can be viewed as good anchor client especially for projects that can be to roll out in phases, for example 8-12 MW (depending on capacity of drilled well). What is important is that geothermal much better option than solar energy that require to cut hectares of native forest that leads to destruction of local ecosystem.

We still to see how actual roadmap for bitcoin mining developments will evolve in El Salvador and what source of funding eventually be available for geothermal power generation. With current position of the government financing from some multinational development banks/institutions (for example IFC, World Bank) might be limited, but since we are living in new multipolar environment the other options could be available to the country. As of now prospects for bitcoin mining deployment are low.

PARAGUAY

Paraguay appears as one of the most dynamic countries in terms of potential for bitcoin mining deployment in LATAM region. Country has strong hydro resources. Bitfarms was one names that initially drew attention to potential bitcoin mining in the country, but since then it’s focus was on expansion into neighbouring Argentina. As of now there is a lot of information with offering of various hosting facilities. Bitmain recently announcing meetup in the country as indication that they see potential market there.

The country has excess capacity of hydropower that it exports to Argentina and Brazil. Being sorely dependant on the river as source of energy it has single point of failure in case of draught. Another contrasting view is that part of population still relies on wood for cooking (that leads to deforestation). So clearly any bitcoin mining development will attract attention and very likely soon become narrative for political battles.

Presidential election on 30 April 2023 won Santiago Pena from leading conservative Colorado Party, the party has longstanding position in Paraguayan politics. However, last year Colorado Party had corruption allegations and US Treasury even sanctioned Horacio Cartes, who was vice president and had to resigned.